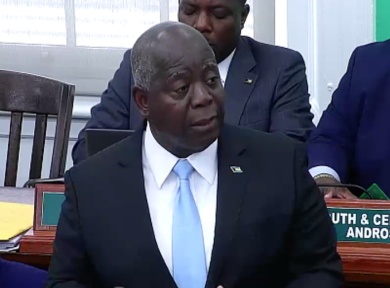

NASSAU, Bahamas, CMC – Prime Minister Phillip Davis introduced a US$3.89 billion price range to Parliament on Wednesday, saying it introduces new measures that reply on to the challenges confronted by the Bahamas and strikes it nearer to the aspirations we share for tomorrow.

Davis advised legislators that the entire income quantities to US$3.89 billion, or 23.6 p.c of the gross home product (GDP), whereas complete expenditure is estimated at US$3.82 billion, or 23.1 p.c of GDP.

He acknowledged that this recurrent expenditure accounts for US$3.44 billion, or 20.8 p.c of GDP, and capital expenditure for US$376.3 million, or 2.3 p.c of GDP.

Davis stated the fiscal surplus is estimated at US$75 million or 0.5 p.c of GDP, with the first steadiness exhibiting a surplus of 4.5 p.c of GDP. He stated that, given this, the debt-to-GDP ratio has been projected at 68.9 p.c of GDP on the finish of the monetary yr 2025-26.

“For the primary time in our historical past as an unbiased nation, a Minister of Finance will likely be tabling a balanced price range, proof that fiscal self-discipline can coexist with a daring imaginative and prescient for nationwide progress,” Prime Minister Davis advised legislators, including that his administration had completed this with out sacrificing growth priorities or slowing the tempo of funding.

“We did it with out resorting to reckless cuts or firing devoted staff simply to say a fast win. This balanced price range is the results of cautious planning, accountable management, and a steadfast dedication to the Bahamian individuals,” Prime Minister Davis stated, noting that “it’s our continued dedication to fiscal accountability that can permit us to proceed making game-changing investments in our nation and our individuals.”

Davis stated that this yr’s income measures are structured round six main themes: affordability, environmental well being, marine safety and growth, modernizing operations, tax measures, and personal cruise locations.

He stated that as a result of latest results of worldwide inflation, economies all over the world, The Bahamas, have confronted vital value will increase, leading to Bahamian households struggling “underneath the load of excessive costs for meals, home goods, and fundamental hygiene requirements.

“This administration understands their issue, and on this price range, we’re appearing decisively to carry aid to the individuals. As a part of the continued efforts to advertise affordability, we will likely be decreasing the value-added tax (VAT) charge to 5 p.c on a spread of merchandise which can be essential for the well-being of our residents”.

He stated these embrace child diapers, female hygiene merchandise, prescription and non-prescription medicine, together with drugs for people with persistent situations, in addition to medical and dental provides reminiscent of needles, blood strain screens, lancets, dental cement, and different dental fillings.

Davis stated that different medical and therapeutic gadgets, reminiscent of cell remedy merchandise, will even profit from the measure that can take impact on September 1 this yr and is “geared toward guaranteeing that Bahamians of all ages and phases of life can entry important merchandise with out the added burden of excessive taxes.”

He stated underneath the amended VAT Act, the federal government can be extending VAT aid on constructing supplies for spiritual establishments in recognition of their important function in supporting and uplifting communities.

“This VAT aid will come within the type of VAT-exempt imports or as a refund system if bought domestically. As well as, customs obligation is being faraway from digital and changeable letter indicators, making it extra inexpensive for them to reinforce their visibility and communication efforts.”

Prime Minister Davis acknowledged that the federal government can be decreasing customs duties on dozens of important gadgets utilized by Bahamians each week. Moreover, his administration is eradicating customs duties on refractory cement, mortars, concrete, and comparable compositions, in addition to copper fittings, screws, and nuts and bolts.

“We’re additionally taking steps to cut back the price of gasoline sources utilized by quite a few households. We’re eradicating the 45 p.c excise obligation on butane gasoline, which is generally utilized in moveable stoves. Many Bahamians depend on this gasoline for a scorching meal, whether or not day-to-day or throughout emergencies,” Prime Minister Davis stated, including, “That is a part of our broader dedication to construct resilience and affordability into on a regular basis life, particularly the place it could assist probably the most”

He acknowledged that the Bahamas is dedicated to decreasing greenhouse fuel emissions by 30 p.c by 2030 and attaining net-zero emissions by 2050, according to the Paris Settlement.

“Our clear power transition contains increasing renewable power, selling electrical autos, and enhancing power effectivity by key initiatives and tasks,” Davis stated, noting that obligation exemptions on family home equipment with the best degree of power effectivity will likely be granted.

“Freezers, air conditioners, freezers, and fuel and electrical water heaters will likely be duty-free as soon as confirmed that the equipment will make a constructive affect on local weather change initiatives,” he stated, including that these exemptions encourage Bahamians to undertake cleaner applied sciences straight contributing to our local weather objectives and a sustainable future.

Prime Minister Davis stated that, along with these measures, prefabricated properties can now be imported with prior approval from the Ministry of Works.

“Each Bahamian has the fitting to protected meals, clear environments, and wholesome communities. To assist this, we’re introducing new measures within the upcoming fiscal yr which can be sensible, truthful, and extra centered on defending public well being,” Prime Minister Davis stated, noting that whereas the Bahamian marine surroundings is among the nation’s biggest treasures, but, for much too lengthy, its use has been under-regulated and its safety underfunded.

“We’re introducing focused measures to make sure that those that profit from our marine house additionally contribute to its sustainability. To higher defend our marine surroundings and assist long-term stewardship of our waters, we are going to introduce a framework to implement an Environmental Levy on seabed leases for business exercise to replicate the true worth of our marine territory”.

Davis stated, as well as, a cruising allow price for tenders and boats 25 ft or bigger will likely be put into place, guaranteeing each vessel has its legitimate allow and that the federal government will introduce environmental penalties to discourage dangerous practices and protect the well being of our marine ecosystems.

“These measures aren’t about discouraging use; they’re about accountable use. They’re about guaranteeing that those that get pleasure from our waters additionally assist to protect them and for future generations of Bahamians to inherit an ocean that’s considerable, wholesome, and guarded. We owe it to our individuals and to the ocean that sustains us.”

Prime Minister Davis advised legislators that the award-winning Debt for Nature Conservation transaction had unlocked US$124 million in funding for marine conservation with out growing the debt burden.

He stated that over the subsequent 15 years, annual financial savings from this settlement will likely be directed to the Bahamas Protected Space Fund, which is able to allocate assets to companies tasked with safeguarding the nation’s marine ecosystems.

“These funds will start to assist the implementation of pre-established conservation targets and guarantee long-term environmental stewardship within the upcoming fiscal yr,” he stated, including that the projected environmental impacts of this initiative are substantial.

He stated this would come with enhanced administration of 6.8 million hectares of Marine Protected Areas, representing almost 17 p.c of our nearshore surroundings, the restoration of vital mangrove ecosystems, which function pure buffers towards storm surges and supply important nursery habitats for marine in addition to strengthened resilience to local weather change, significantly in coastal communities weak to rising sea ranges and excessive climate occasions; and the institution of a US$20 million conservation endowment by 2039, guaranteeing continued funding for marine safety past the 15-year time period.

Prime Minister Davis stated that to strengthen enforcement, the federal government will create a Maritime Income Unit inside the Ministry of Finance. As well as, members of the Royal Bahamas Police Power, the Royal Bahamas Defence Power, Port Officers, and different designated authorities will likely be empowered to challenge notices, impound non-compliant vessels, and, the place essential, eliminate such vessels on the proprietor’s expense.

Prime Minister Davis acknowledged that the price range shouldn’t be solely about offering aid but additionally goals to construct a brighter, fairer, and extra fashionable Bahamas.

“This is the reason this authorities will put in place the correct insurance policies and frameworks that had been lengthy wanted. We’ll set up the Asset Disposal Evaluation Unit, which is able to study bodily authorities belongings and advocate the optimum methodology for disposal. They are going to advocate whether or not a public asset must be transferred to a different public entity, offered, recycled, destroyed, or every other methodology they see match.”

He stated the Asset Disposal Evaluation Unit will help in selling accountability, honesty, and transparency for public belongings which can be not of their supposed use.

“On this price range, we’re taking significant steps to modernize how authorities works, the way it taxes, the way it prices, and the way it serves,” he stated, including, “In terms of Actual Property Tax, equity is our tenet.

“House owners of derelict properties will likely be eligible for a waiver or credit score on all excellent property tax arrears as soon as these properties are repaired and made liveable once more. To make sure transparency and equity, we are going to put in place a pre-approval course of to verify the property’s derelict standing earlier than any repairs start.”

To advertise fairness among the many Actual Property Tax base, the federal government ought to higher outline “owner-occupied” and take away its seasonality by changing it with a specified interval for overseas owners.

“Overseas owners will qualify for the partial owner-occupied exemption for property values as much as US$300,000 in the event that they keep greater than 90 days in The Bahamas. In the event that they keep greater than 183 days, full exemption will likely be utilized, which incorporates each the residential cap and the US$300,000 exemption tied to worth.”