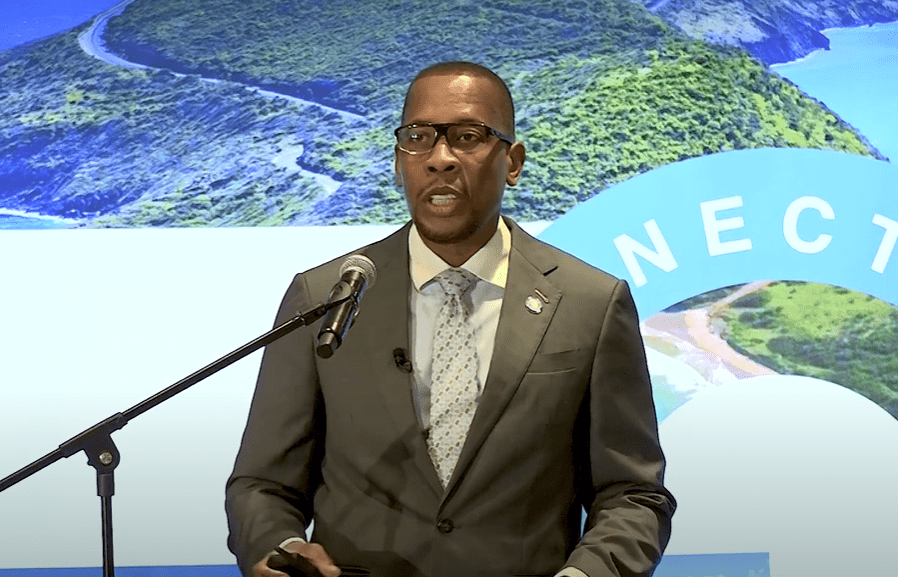

BASSETERRE, St Kitts, CMC — Governor of the Jap Caribbean Central Financial institution (ECCB), Timothy N. J. Antoine, says political help is critically necessary to the profitable creation of a regional regulator for Citizenship by Funding (CBI) packages throughout 5 nations within the Jap Caribbean Foreign money Union (ECCU).

Talking on the St Kitts and Nevis Funding Gateway Summit this week, Governor Antoine mentioned the ECCB is spearheading the initiative by way of an Interim Regulatory Fee (IRC), which was appointed by the 5 taking part nations: Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, and Saint Lucia to supervise the institution of the regulator.

As soon as established, the regulator can be accountable for supervising, regulating, and licensing all CBI packages within the area.

“I wish to be very clear: we took a deliberate step. It required us to journey and interact in an intense schedule, however we didn’t wish to draft [a legal framework] earlier than we engaged you,” Governor Antoine mentioned. “Our preparation has been enriched by what you will have shared with us.”

He mentioned consultations over the previous three months concerned governments, opposition leaders, native brokers, builders, monetary intelligence items, and banks. As well as, worldwide companions, together with the USA, the UK, and the European Union, in addition to regional Attorneys Common, had been additionally engaged within the course of.

“We’ve now submitted our second draft to our heads — our Prime Ministers,” Governor Antoine mentioned.

The IRC plans to share the draft with trade stakeholders this month for suggestions, to finalize it by the top of July, and submit the ultimate model in early August.

“Our [the IRC’s] deliverables are a draft settlement and invoice, which now we have now submitted; an inventory of coverage points, which now we have additionally submitted; and a danger evaluation and protocols, which we’re engaged on and can submit as soon as finalized,” Governor Antoine added.

He additionally defined that the regulator would operate below a single enabling regulation, just like how the ECCU Banking Act applies throughout the Foreign money Union.

The regional regulator is anticipated to set and implement widespread requirements for due diligence, advertising and marketing, outsourcing, stakeholder engagement, and different key areas. These unified requirements, Antoine mentioned, would shut authorized loopholes, scale back unfair competitors, and reduce regulatory arbitrage between the nations.

Governor Antoine emphasised the significance of presidency backing.

“We imagine now we have that help, and that has pushed us as now we have proceeded. The Heads requested us to do that, and the Heads will take this to Parliament and enact it earlier than the top of the yr,” he mentioned.