NASSAU, Bahamas, CMC – The Bahamas authorities has reiterated its assist for a United Nations decision selling inclusive and efficient worldwide tax cooperation. It’s ready to help the worldwide physique in establishing “a good, clear, and balanced worldwide tax regime.”

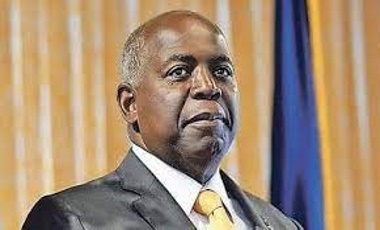

Prime Minister Phillip Davis, in an announcement, mentioned Nassau regards the decision as “historic, selling fairness in international tax administration and in search of to ascertain a framework conference on tax which may finally transfer decision-making on international tax guidelines from the Organisation for Financial Cooperation and Growth (OECD), a small membership of wealthy international locations, to the UN.”

Davis mentioned the United Nations’ determination to endorse a extra inclusive tax governance framework marks a profound development for international financial and tax coverage, “a trigger,” which he mentioned his nation “has lengthy championed.

“This improvement intently displays our complete report back to the UN Secretary-Normal, advocating for a good tax system that embraces the various fiscal landscapes of all nations and notably helps the financial realities of creating international locations,” Davis mentioned.

In his letter to UN Secretary-Normal Antonio Guterres, Prime Minister Davis mentioned that Nassau’s dedication to sustaining the very best tax compliance requirements is unwavering, “and this historic second is a testomony to our dedication to overcoming the inequities propagated by present tax coverage frameworks and establishments.

“We have now persistently emphasised the necessity for a reformed international tax construction that honors the sovereignty of countries like The Bahamas, which have been disproportionately affected by the World North’s biased insurance policies.”

Davis mentioned the Bahamas is totally ready to have interaction with the United Nations to form a tax system that ensures transparency, justice, and sustainable improvement.

“We pledge to steer and advocate tirelessly for insurance policies that defend the financial pursuits of all international locations, with a deal with these traditionally sidelined in international tax negotiations. The Bahamas will draw on our experiences to assist a good, clear, and balanced worldwide tax regime,” he added.

In September, Prime Minister Davis, addressing the two-day summit of the Group of 77 and China in Cuba, mentioned that the United Nations is the suitable physique to design and construct a really equitable and inclusive worldwide tax administration structure with equal footed illustration, an surroundings of 1 nation, one vote.

“For too lengthy, we have now all lived in an surroundings the place international tax coverage was mandated and designed by the OECD the place ideas underpinning the present worldwide tax system choose the pursuits of the worldwide north, that’s, OECD members and developed international locations, on the expense of small creating international locations, primarily black ruled former colonies within the World South, former colonies of those self same members of the OECD.”

Davis mentioned that the arbitrary and discriminatory actions of the OECD and European Union have disproportionately affected international locations of the worldwide south, already reeling from actions and impacts of nations from the worldwide north.

Associated