ST. GEORGE’S, Grenada, CMC – The Grenada authorities Monday stated that it could be auctioning a 5 million EC greenback (One EC greenback=US$0.37 cents) retail bond on the St. Kitts-based Japanese Caribbean Securities Trade (ECSE) as a part of a partnership with the Japanese Caribbean Central Financial institution (ECCB) geared toward encouraging residents to take a position as an alternative of rising their financial savings at business and indigenous monetary establishments.

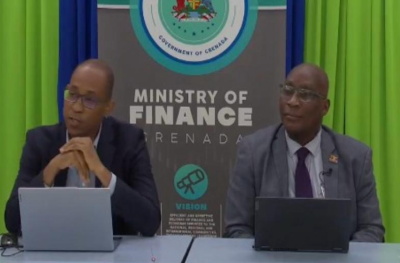

Finance Minister Dennis Cornwall advised a information convention that this preliminary retail auctioning bond might be a part of a pilot challenge by the ECCB, which additionally entails St. Kitts and Nevis.

“We’re certainly one of two pilots, St Kitts and Nevis being the opposite one,” he stated, saying the phrases and situations of the bonds in addition to the date and time interval they are going to be auctioned.

The finance minister stated that such an initiative is essential as a result of it is going to present residents with a possibility to take a position.

“Our authorities recognises that it’s merely not sufficient to inform folks that they need to save, we should give them the instruments and, extra importantly, the chance to develop monetary literacy and to develop their wealth,” he stated.

The bonds might be auctioned from October 31 to November 21, and they are going to be assigned on a first-come, first-served foundation for residents of the Japanese Caribbean Forex Union (ECCU), specifically Antigua and Barbuda, Dominica, Grenada, St. Kitts and Nevis, St. Lucia, and St. Vincent and the Grenadines.

The brokers might be these already authorised by the ECSE that present their providers for the Regional Authorities Securities Market (RGSM).

The minimal funding is EC$500, and the utmost is EC$50,000. All candidates should pre-register through a portal on the Ministry of Finance Web site, and the dealer for every island will then contact the applicant through the due diligence course of.

The 2-year government-backed bond gives a set annual rate of interest of 4.25% with semi-annual funds in Could and November of every yr.

Mike Sylvester, Everlasting Secretary within the Ministry of Finance, said that the bonds are supposed for households, slightly than monetary establishments similar to banks and credit score unions.

“It’s for unusual of us, unusual households to have the ability to begin that funding journey and to have the ability to put money into protected and safe investments,” he stated, including that the initiative will not be for the Authorities to lift financing. Nonetheless, it’s a possibility for empowering individuals.

A separate prospectus for the five-million-dollar bond might be revealed individually from the prospectus that gives details about the auctions of the Authorities’s treasury payments and bonds by means of the ECSE scheduled for 2025.

In line with Grenada’s 2025 prospectus on the alternate, the Authorities plans to lift EC$60 million by means of 91-day Treasury Payments and EC$45 million by means of 365-day Treasury Payments at completely different dates throughout February, Could, August, September, October, and December.

To date, many of the auctions have been oversubscribed. The EC$15 million Treasury Invoice auctioned by the Regional Authorities Securities Market on September 02 was oversubscribed and raised 5 million EC {dollars} greater than the focused quantity.