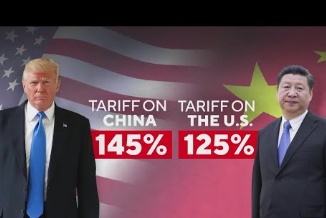

PORT OF SPAIN, Trinidad, CMC—The Vitality Chamber of Trinidad and Tobago says the chaos in world buying and selling networks created by the US tariffs and the commerce conflict between the world’s two largest economies has critical implications for the nation.

It stated probably the most speedy impression was the sharp drop in oil costs, with benchmark Brent dropping from near US$75 a barrel originally of April to US$64 by the tip of final week. The Vitality Chamber stated this drop was in response to the financial uncertainty created by the tariffs and an Group of Petroleum Exporting Nations (OPEC) choice to extend manufacturing.

It stated that whereas Trinidad and Tobago is primarily a gas-based financial system, with gasoline accounting for nearly 90 % of hydrocarbon manufacturing on an power equivalence foundation, oil continues to be an necessary supply of presidency income by petroleum income taxes, supplemental petroleum taxes, royalties, and dividends from state-owned Heritage Petroleum.

This fiscal 12 months’s annual authorities income estimates have been primarily based on an oil worth of US$77.80 per barrel.

The brand new LNG pricing formulation agreed between the federal government and the Atlantic shareholders, primarily based on a mixture of Asian and European LNG benchmark costs and Brent crude costs, imply that the decrease oil costs may even impression the nation’s Liquified Pure Gasoline (LNG) export costs.

The Vitality Chamber stated Japanese and European LNG costs have additionally retreated, although they continue to be at traditionally excessive ranges, above US$10 per MMBtu, in comparison with Henry Hub costs within the US$3.50 vary.

It stated that the 2025 authorities income estimates have been primarily based on a median wellhead worth of US$3.59, a mixture of each LNG advertising contract costs and home gasoline costs masking a spread of contracts.

“Methanol costs usually broadly comply with world financial ups and downs, on condition that demand for methanol is intently correlated with financial exercise. It is a vital fundamental chemical enter right into a broad vary of merchandise.”

The Vitality Chamber stated methanol costs have been comparatively excessive within the first quarter of 2025, however a world downturn could trigger important draw back threat over the following few months.

“Methanol exports from Trinidad to the USA can be topic to the brand new ten % import tariffs, however it’s unclear how this can impression the market, particularly because the US just isn’t a very necessary marketplace for Trinidad methanol.”

Concerning ammonia, the Vitality Chamber stated that Trinidad is a vital producer for the US, accounting for over 40 % of imported ammonia into the US.

“Regardless of the tariff imposition, ammonia markets have remained comparatively muted. With most ammonia manufacturing going into fertilizers, the impression of

“Urea costs within the US rose final week in response to the tariffs with some urea-producing nations being threatened with the upper reciprocal tariffs) however it’s unclear how they are going to reply sooner or later. It would take some time for the entire image to emerge. ”

Nonetheless, the Vitality Chamber stated that one constructive impact of decrease oil costs is that the value of imported gasoline, diesel, and jet gasoline must also decline. Nonetheless, it must be remembered that we export roughly two occasions extra crude oil than we import petroleum merchandise.

The implications of world commerce and financial uncertainty transcend falls in commodity costs. One essential issue is how the commerce conflict between the US and China and the ten % tariff on US imports may disrupt provide chains. With so many imports coming from or by the US, inflation brought on by the brand new tariffs will inevitably movement by to the Caribbean.

“Whereas meals inflation is the problem that may most likely hit the typical citizen first and most clearly, there are additionally implications of the availability chain disruptions for the power sector.

“China is a vital producer of many parts that go into gear and different provides used within the power sector. If these gadgets are assembled within the US, the unprecedented tariffs positioned on Chinese language imports into the US will result in important worth will increase.

“The hazard is that this can push up prices within the Trinidad power sector, particularly for something sourced from the US. The power sect,” the Vitality Chamber added.

Firms could search for alternate options or buy straight from Chinese language, European, or different Asian suppliers. Just a few Trinidadian producers, similar to IAL Engineering, who can produce some gadgets for provide to home and regional markets, could have some upside potential.

“The overall sense of uncertainty will inevitably result in many firms delaying funding choices. Confidence is a vital commodity in any enterprise, and it’s in brief provide worldwide and in Trinidad and Tobago,” the Vitality Chamber stated.