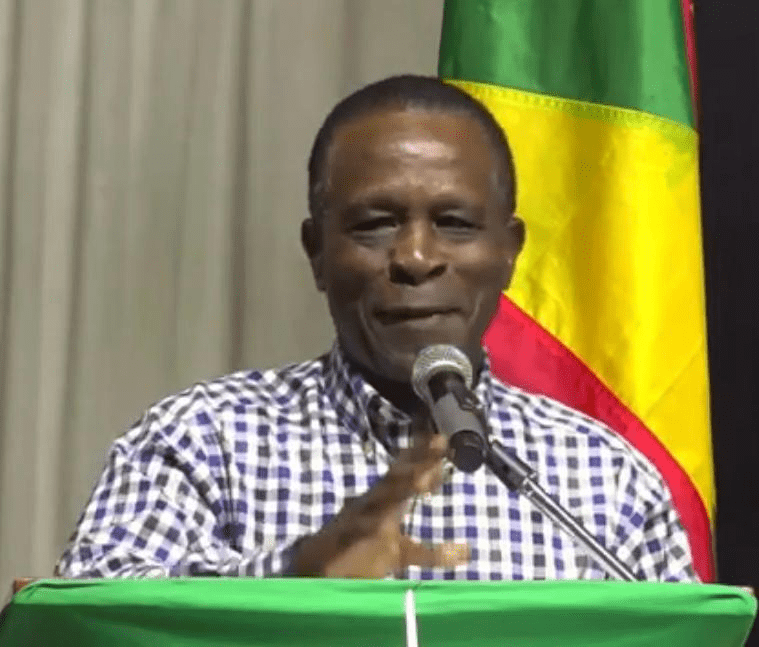

ST GEORGE’S, Grenada, CMC—Former Prime Minister Dr Keith Mitchell believes that the federal government’s announcement that it’s going to search Parliament’s approval to borrow EC$725 million to fund developmental initiatives in 2025 will enhance the Gross Home Product (GDP) ratio in a single day.

“You can’t be proud as a result of it signifies that the debt to GDP ratio of this nation will leap up in a single day and frighten each critical monetary individual that understands finance,” Mitchell informed delegates attending the New Nationwide Social gathering Girls’s Arm Conference on the weekend.

He mentioned that anybody who took a first-level economics class in any faculty would let you know that one thing is basically fallacious with any group searching for this massive amount of cash to fund initiatives on a funds.

The most recent Worldwide Financial Fund (IMF) Article IV Session on Grenada, revealed earlier this month, says Grenada revoking the suspension clause of the Public Finance Administration Act is crucial for the nation to achieve the goal of 60% of GDP by 2030.

“Assuming a subsequent well timed return to the fiscal guidelines, public debt is projected to proceed falling and attain the debt goal of 60 % of GDP by 2030,” mentioned the report. Grenada suspended its fiscal guidelines following the passage of Hurricane Beryl in 2024.

Final week, Finance Minister Dennis Cornwall introduced that the foundations will stay in place till 2026, and the federal government will current the 2025 funds or Estimates of Income and Expenditure on March 7.

He additional defined that along with searching for Parliament’s approval for the funds, the Parliament would even be requested to approve a funds mortgage authorization invoice of roughly EC$725 million.

“We are going to current to the Parliament a possibility to have us borrow extra cash for all our improvement initiatives that can be arising. I’ll wait till that quantity is finalized earlier than I announce it to the nation…I do know the ballpark determine we’re searching for is over EC$725 million,” he mentioned within the information convention.

Since coming into workplace in June 2022, every funds introduced by the Dickon Mitchell administration has seen a rise within the funds Mortgage Authorization Act following the presentation of the funds for the upcoming yr.

The 2023 funds, introduced in December 2022, had a funds mortgage authorization invoice of EC$350 million; beforehand, it was EC$300 million; the 2024 funds, introduced in December 2023, had a funds mortgage authorization Invoice of EC$375 million.

Part 56(1) of the Public Finance Administration Act authorizes, by decision of the Home of Representatives, the Minister of Finance to borrow on behalf of the Authorities of Grenada in any type and from any professional supply, whether or not home or exterior and for any fiscal goal, on phrases and situations to be agreed with any creditor, an quantity not exceeding within the combination the sum specified within the decision.

It is a authorized requirement that should accompany, and has accompanied, each annual Nationwide Funds underneath all Governments, ought to there be a must borrow at any time in the course of the yr.

Cornwall mentioned that Grenada, which raised greater than EC$100 million on the Japanese Caribbean Securities Trade in 2024 by auctioning treasury payments to refinance current Treasury payments and Treasury notes at present available on the market, will look to boost extra funds by way of that medium in 2025.