PORT OF SPAIN, Trinidad, CMC – The Trinidad and Tobago authorities has launched new laws to scale back the residential property tax charge by as a lot as 33 %.

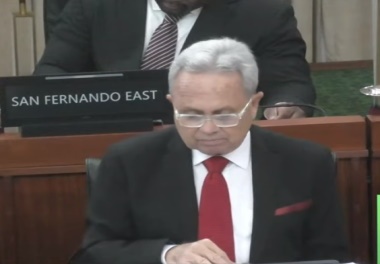

Finance Minister Colm Imbert stated the Property Tax (Modification) Invoice, 2024, will likely be debated on Monday.

Imbert instructed legislators on Friday that the brand new laws is meant to scale back the speed of residential property tax from three to 2 %, “which represents an efficient discount of property tax by 33 %.

“That is supposed to scale back the affect of the brand new valuations since it’s clear that some property house owners imagine that the previous 1948 valuations ought to nonetheless be used within the trendy period, in 2024, and it is very important regulate and proper that inaccurate perception progressively”.

He stated it might additionally lengthen the time till June 30, 2024, for the Board of Inland Income to situation Notices of Evaluation.

“This may allow extra time for the Valuation Division to evaluate valuations underneath question, regulate the place mandatory, and advise the Board of Inland Income(BIR) of any tax assessments that should be up to date.”

As well as, the brand new laws will permit for extending all relevant intervals by Order, as is the case underneath the Valuation of Land Act.

Imbert stated this is able to be certain that the federal government can lengthen any additional deadlines underneath the Property Tax Act if required, inclusive however not restricted to the date upon which Property Tax is to be paid and the date upon which penalties are incurred.

Imbert stated he additionally needed to advise that Rules to offer impact to the deferral type required underneath part 23 of the Property Tax Act have been made on Thursday and will likely be revealed on Friday.

“This can permit indigent, aged, and infirm individuals who fulfill the factors underneath part 23 of the Property Tax Act to use to the Board of Inland Income for the deferral of Property Tax.”

The Finance Minister stated additional that an Order will quickly be revealed extending the interval for individuals to deliver objections to valuation notices from 30 days to 6 months.

“Importantly, this era solely commences after the discover of valuation is served on the residential land proprietor or occupier. The federal government’s intention right here is obvious: it intends to be clear in regards to the valuations despatched to residential land house owners and occupiers by the Commissioner of Valuations.

It’ll give house owners and occupiers further time to lodge objections, which should be decided and answered by the Commissioner of Valuations within the first occasion earlier than being adjudicated upon by different authorities if there’s nonetheless a dispute”.

Imbert stated that the federal government expects these measures to go a good distance in addressing the teething points at the moment being confronted. “We additionally undertake to take all mandatory and future legislative and operational measures wanted to make sure that Property Tax is carried out equitably throughout Trinidad and Tobago.”

Nevertheless, he expressed his disappointment at notices posted on the doorways of some Regional Income Assortment Workplaces on Thursday stating that property tax funds had been suspended till additional discover.

“These notices weren’t licensed and shouldn’t have been put up, particularly as a result of the Property Tax Modification Act 2024 will not be but legislation,” he stated.

Imbert instructed Parliament that his investigations have revealed that a few of the BIR employees, after changing into conscious of the provisions within the modification invoice, “took it upon themselves to do that, with apparently good intentions, however with out authorization, and my data or consent.

“Nevertheless, that is completely different from how a Cupboard resolution must be communicated to the general public, particularly on a matter as delicate as this.

“I’m disillusioned that this procedural lapse occurred, and I hope and count on that the general public servants concerned will study from this error. On behalf of the federal government, I want to categorical my deep remorse to all inconvenienced,” Imbert stated.

He instructed legislators that now that the Invoice is earlier than the Parliament, he has requested the Everlasting Secretary within the Ministry of Finance to request the BIR stop gathering property tax till the brand new charge of residential property tax is in impact.

“Moreover, I’ve been suggested by the BIR that as much as Wednesday, March 15, 2024, 801 property tax funds had been made for TT$1,030,864.55 (One TT greenback = US$0.16 cents), a median of TT$1,297 in annual property tax. All of those taxpayers will likely be issued new tax notices on the new charge of two % and refunded, and I’ve requested the BIR to take action promptly,” Imbert stated.

Associated