BRIDGETOWN, Barbados, CMC – The Central Financial institution of Barbados (CBB) Wednesday mentioned. On the similar time, the native financial system exhibited vital resilience over the past two years, and the outlook for 2024 and into the medium time period seems cautiously optimistic.

In its Overview of the Barbados Financial Efficiency, January to December 2023, the CBB mentioned that regardless of dealing with world and native headwinds, the Barbados financial system sustained its development trajectory, pushed by the sturdy efficiency of the tourism sector.

“Amidst challenges similar to elevated international rates of interest, geopolitical tensions, and native climatic occasions affecting agricultural output and native costs, the Barbadian financial system demonstrated resilience and continued its upward development path in 2023,” mentioned CBB Governor Dr. Kevin Greenidge.

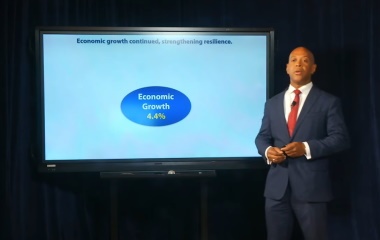

He mentioned that anchored by thriving tourism, the financial system registered an estimated development of 4.4 % and that “this sturdy growth not solely bolstered transaction-based tax revenues but additionally contributed considerably to lowering the debt-to-gross home product (GDP) ratio, narrowing the exterior present account deficit, and enhancing the profitability of the monetary sector.

“The expectations are that GDP will develop additional, by about 4 % in 2024 and into the medium time period, predicated on steady investments by each the private and non-private sectors,” the CBB mentioned, including that as Barbados charts its course for 2024, a return to pre-pandemic stage vacationer arrivals by the top of the yr is anticipated.

“Early ahead bookings sign renewed curiosity from vacationers in visiting Barbados whereas steady development in seating capability represents the airways’ rising confidence and willingness to fulfill the demand for journey to the vacation spot,” mentioned CBB Governor

He mentioned that internet hosting Worldwide Cricket Council (ICC) World Cup matches and intensified advertising and marketing methods also needs to garner vital curiosity within the vacation spot throughout the summer season months.

“Elevated customer demand for native items and providers ought to contribute to broader financial development via the related exercise in wholesale and retail, transportation, building, and different ancillary sectors.”

The CBB mentioned that the Barbados Financial Restoration and Transformation 2022 (BERT 2022) Plan focuses on amplifying funding to make sure sustainable financial development over the medium time period.

It mentioned that the BERT 2022 Plan goals to attain a public funding to GDP ratio of 5 % and double personal sector funding to fifteen % of GDP, estimated at BDS$1.9 billion (One Barbados greenback=US$0.50 cents) yearly over the medium time period – the subsequent 4 to 5 years.

The CBB mentioned that international direct funding (FDI) should additionally choose as much as over one billion {dollars}.

“Specializing in key areas similar to tourism, infrastructure, and the power sector, the BERT 2022 Plan not solely goals to spice up productiveness and modernize the financial system but additionally seeks to strengthen very important interconnections throughout numerous sectors. This method ensures inclusive advantages for all communities and sectors in Barbados.”

Greenidge mentioned it is very important observe that the expansion outlook stays unsure and is topic to a number of dangers. He mentioned a projected world financial slowdown and potential geopolitical conflicts are draw back dangers to the 2024 forecast.

Based on the October 2023 Worldwide Financial Fund (IMF) World Financial Outlook, a world financial slowdown is anticipated in 2024, pushed by financial coverage tightening in superior economies and conflicts within the Center East and Europe, impacting worldwide journey demand.

“To adapt, Barbados’ tourism trade should deal with providing distinctive and enriching experiences past the traditional seashore vacation, showcasing the island’s wealthy tradition, pure magnificence, and assorted points of interest,” the Governor mentioned.

He mentioned the willingness to embrace the rising sharing financial system displays the trade’s dedication to diversifying tourism choices.

“By remaining agile, adapting to altering tendencies, and inspiring collaboration, Barbados’ tourism sector is about to get better and flourish as a prime world performer. Over the medium time period, the principle dangers to the forecast are failure to extend funding, notably personal and FDI investments, and to finish the reforms of the State-OwnedEnterprises (SOEs) within the curiosity of larger effectivity within the allocation of public funds and higher service supply.”

The CBB mentioned home inflation is projected to recede within the medium time period by falling worldwide commodity costs.

The 12-month shifting common inflation price is anticipated to average to three.5 and 4 % by the top of 2024, supported by declining power costs. Nonetheless, medium-term inflation forecasts face potential dangers from worldwide occasions similar to the continuing Russia-Ukraine Battle, escalating conflicts within the Crimson Sea area, and continued congestion within the Panama Canal.

Furthermore, the frequency and severity of adversarial climate situations at dwelling may result in meals shortages and escalate meals worth inflation. Conversely, the CBB famous that the brand new commerce agreements with international locations like Suriname and Guyana may assist scale back meals worth inflation over the medium time period.

It mentioned sturdy development in tourism and strategic investments are set to bolster Barbados’ worldwide reserves and stabilize its financial system towards world market fluctuations.

“The nation’s worldwide reserves place is anticipated to be fortified by the projected development in tourism exercise, ongoing funding help from world monetary establishments, and international funding flows for tourism-related initiatives.

“As well as, elevated international alternate financial savings are anticipated within the medium time period with the continued push to extend the inventory and use of renewable power merchandise and develop the nation’s home meals manufacturing capability. These ongoing developments will help in cushioning the volatility of worldwide meals and gas costs,” the CBB mentioned.

Greenidge mentioned fiscal self-discipline and strategic reforms have led to a main surplus, underpinning the federal government’s monetary stability and future effectivity good points.

He mentioned regardless of the lower-than-anticipated income outturn within the first 9 months of the monetary yr 2023/24, the federal government has maintained fiscal self-discipline and achieved the top December 2023 main stability goal of BDS$378 million, which bodes nicely for assembly the first stability goal of BDS$446 million on the finish of March 2024.

The state-owned enterprises (SOEs) reform program, together with the restructuring of the Barbados Agricultural Administration Co Ltd (BAMC), the amalgamation of the Rural and City Improvement Companies, and the reform of the Nationwide Housing Company, is a big step in direction of attaining medium-term effectivity good points, in response to the CBB.

“Moreover, reforms within the company tax construction, aimed toward assembly OECD Inclusive Framework Globe Guidelines, are anticipated to yield a internet tax constructive place within the medium time period,” it famous, including that “these good points will help the federal government’s implementation of important capital funding applications whereas adhering to its main stability targets that guarantee debt sustainability.”

The CBB mentioned regardless of greater international rates of interest, the debt-to-GDP ratio is sustainable and heading in the right direction to fulfill the 2035/36 monetary yr goal.

“The revival of the home securities market alongside exterior borrowing will help in assembly the federal government’s financing wants,” Greenidge mentioned, noting, nevertheless, that regardless of the rise in debt over the interval, the growth in financial exercise and sustained main surpluses ought to pave the way in which for attaining the 60 % debt goal by the 2035/36 monetary yr.

The central financial institution mentioned that sustaining ample capital buffers and extra liquidity will bolster the soundness of the monetary system.

“The anticipated improve in financial exercise is anticipated additional to dampen the extent of non-performing loans (NPLs) and increase credit score demand, supporting family expenditures and enterprise investments.

“In flip, these developments are prone to generate elevated profitability and decrease provision bills within the banking sector, thereby strengthening the adequacy of capital buffers. Though the deposit development will probably proceed to sluggish as ongoing financial exercise will spur demand for imported items and providers, liquidity ranges are anticipated to stay secure.”

Greenidge mentioned {that a} united and proactive method is important in harnessing development alternatives and navigating future challenges to safe Barbados’ financial prosperity.

“As Barbados strides in direction of a brighter financial future, the decision to motion is evident. Private and non-private stakeholders should seize the alternatives introduced by the BERT 2022 Plan, specializing in sustainable investments in tourism, infrastructure, and power.

“The personal sector, particularly, ought to capitalize on the potential for development and innovation, particularly in gentle of the rising world challenges. We should collectively embrace change, encourage investments, and help reforms to make sure a resilient and thriving Barbadian financial system for the years forward,” the CBB Governor added.

Associated