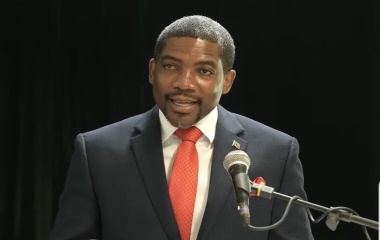

BASSETERRE, ST KITTS, CMC – Prime Minister Dr. Terrance Drew offered a funds of EC$1.09 billion.on Wednesday, It instituted a sequence of transformative monetary aid initiatives, offering much-needed assist to the Twin Island Federation.

Within the Price range Tackle within the Nationwide Meeting, Drew reaffirmed the Authorities’s determination to not introduce new taxes within the upcoming fiscal 12 months.

“Our Authorities is just not proposing to introduce new taxes right now. We’re, nevertheless, making progress relating to the excellent evaluation of the tax regime.”

The Prime Minister additionally highlighted the progress made within the complete evaluation of the prevailing tax regime.

“Earlier this 12 months, the Authorities collaborated with the Worldwide Financial Fund (IMF) to start this evaluation course of. The draft report of this evaluation is anticipated to be finalized in early 2024, with the outcomes to be shared with stakeholders subsequently. This initiative goals to reconfigure the tax regime to diversify income sources and scale back dependence on particular sectors or sources of revenue,” he stated.

Drew’s announcement displays the Authorities’s strategic method towards financial administration, emphasizing the significance of a diversified and sturdy fiscal framework that helps the nation’s development and growth.

He added that his Authorities stays dedicated to fostering a conducive surroundings for financial stability and development, making certain that the nation’s fiscal insurance policies align with its residents’ broader targets of sustainable growth and prosperity.

This determination aligns with the stance offered in his maiden Price range Tackle final December. It demonstrates the Authorities’s dedication to a secure and predictable fiscal surroundings for its residents and companies.

The announcement of an eight % basic wage enhance for all civil servants and pensioners, efficient January 1, 2024, was made to acknowledge their invaluable contributions to the federal government service.

“This enhance displays our appreciation to your contributions to the Authorities service as we firmly consider that your efforts ought to be acknowledged and pretty compensated,” Drew said.

In a present of additional appreciation, a Christmas Bonus equal to 50 % of their wage will probably be granted to all civil servants and Authorities Auxiliary Staff (GAEs), together with Pensioners and STEP staff, on December 21.

Not limiting the generosity to the civil service, he additionally introduced a groundbreaking “Staff’ Bonus” initiative, granting non-civil servants a bonus of EC$500 in December.

This bonus will probably be disbursed by way of the Saint Christopher and Nevis Social Safety Board, marking a historic transfer within the Federation and the Caribbean.

“We don’t need to simply go away the bonus, after all, when the financial system has not totally recovered, to simply the civil servants. We additionally need to give a bonus to these not within the civil service”.

Drew emphasised that this unprecedented Staff’ Bonus is the primary of its variety within the area, straight disbursed by the Authorities to non-civil servants.

He famous that these people, essential to the non-public sector, have confronted substantial monetary challenges exacerbated by the COVID-19 pandemic. Acknowledging their resilience and dedication, the Authorities has expressed gratitude by way of this landmark monetary aid initiative.

The Prime Minister additionally introduced plans to ascertain a Monetary Schooling and Financial savings Programme.

The Monetary Schooling and Financial savings Programme, a collaborative effort between the Jap Caribbean Central Financial institution (ECCB) and numerous stakeholders, is an important a part of the Authorities’s devoted give attention to enhancing the monetary literacy and well-being of the nation’s youths.

“In pursuit of this dedication, we current a groundbreaking initiative designed to revolutionize the monetary panorama for our youth, one that can instill monetary duty and funding information within the youth of St. Kitts and Nevis.”

He added, “Protecting essential matters like budgeting, saving, investing, entrepreneurship, and understanding monetary markets, this program will empower our youth with the information wanted to navigate the complexities of the monetary world. Madam Speaker, the financial savings side of this initiative is equally revolutionary. Each younger citizen aged 5 to 18, Madam Speaker, will probably be endowed with a financial savings account, initially funded with EC$1,000.”

He stated that EC$500 will probably be invested in shares of presidency majority-owned corporations, together with the St. Kitts-Nevis-Anguilla Nationwide Financial institution.

In regards to the promise of a rise within the Nationwide Minimal Wage Price, he stated this will probably be launched in a phased method beginning January 2024 with a rise of EC$10.75 an hour or EC$430 for a 40-hour work-week.

In explaining the small print of the phased minimal wage charge enhance, he stated it could inevitably attain a max of $12.50 an hour or $500 weekly working a 40-hour work week by July 2025.

“It’s subsequently with nice pleasure that I announce that a rise within the minimal wage will carried out efficient January 01, 2024. It will likely be finished in a phased method – the hourly minimal wage will probably be elevated from $9 to $10.75 per hour, efficient January 01, 2024. Madam Speaker, our projections are the speed would then be elevated to $12.50 per hour from July 01, 2025. The rise in hourly charge will lead to a weekly charge of $430 from January 01, 2024, from $360 and $500 per week from July 01, 2025. Our Authorities is set to make sure that this vital coverage initiative improves the folks’s way of life in our workforce.”

Drew defined how the rise within the minimal wage charge will influence folks, together with elevated payouts from social safety at a pensionable age.

“Are you aware why we want the minimal wage enhance, Madam Speaker? As a result of while you retire, you get extra from Social Safety. When you’ve got an elevated minimal wage, you’ve got extra spending energy; you’re in management, you’ll be able to method a monetary establishment, [and] higher your fiscal place that will help you to achieve extra impartial residing … that’s the reason we consider in adjusting folks’s wages in order that they work for it, however on the identical time we’re doing this we’re asking our staff to work. So, we are going to introduce a Productiveness Taskforce in St. Kitts and Nevis. We’ve got already began to work as a result of, on the identical time, we consider in giving advantages; it must be a two-way road. We give, and also you give, and collectively we work – extra productiveness, extra wealth, extra advantages – that’s what we need to convey to the folks of St. Kitts and Nevis… so we’re matching it with our productiveness outlay, which will probably be launched to the folks in 2024.”

Pointing to auxiliary staff, he stated they have been remembered.

“I’m actually happy to announce that the brand new contributory pension plan will probably be operationalized on January 01, 2024. Sure, as well as, the provisions of the Pensions Modification Act Cap. 2022.06 shall come into pressure retroactively from Could 18, 2012. Because of this all authorities auxiliary workers and different month-to-month paid staff employed by the Authorities on or after Could 18, 2012, are eligible to learn underneath the Act… At present, I’m thrilled to share different nice information with our civil servants. However I need to put in place, Madam Speaker, let it soak in a bit that the GAE staff, even those that are retired – you’re going to get your cash.”

He additionally introduced that the Company Revenue Tax charge for companies registered within the Federation will probably be formally set at 25 %, efficient January 01, 2024.

This determination follows a interval of momentary reductions within the Company Revenue Tax charge, which have been initially carried out till June 2023 and subsequently prolonged to December 2023.

This coverage, he famous, is an funding within the nation’s future, fostering an surroundings conducive to enterprise development, innovation, and group prosperity.

“It’s our expectation, subsequently, that with a decrease tax charge, companies would use the resultant financial savings to increase their operations to offer extra revolutionary services and products, reinvest the funds in analysis and growth in addition to new applied sciences, and most significantly, make use of extra folks,” stated Drew. “This not solely enhances the competitiveness of native companies on the regional and worldwide stage but in addition drives financial development and innovation domestically.”

Associated