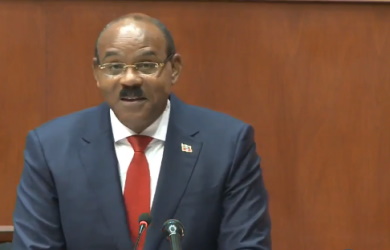

ST. JOHN’S, Antigua, CMC – Prime Minister Gaston Browne has introduced an EC$1.3 billion (One EC greenback=US$0.37 cents) funds to Parliament on Friday, asserting the introduction of a number of fiscal measures he mentioned would strengthen income assortment, cut back distortions within the tax system and enhance taxpayer compliance.

Browne instructed legislators that these measures embrace lowering tax concessions granted, particularly discretionary exemptions, including,” We acknowledge that concessions and tax incentives are required to encourage investments in new initiatives and vital industrial expansions.”

However he mentioned whereas his administration would proceed to offer these concessions as required and by the Antigua and Barbuda Funding Authority (ABIA) Act and the Small Enterprise Improvement Act, “for ongoing routine enterprise operations to incorporate consumables, these concessions can be discontinued.”

Browne mentioned that the Authorities will implement the elevated property tax charge on properties valued at greater than three million {dollars} and a ten % excise tax on alcohol, tobacco, and hashish merchandise.

He mentioned there can be a rise within the cash switch levy from two to 5 % and broadening the Antigua and Barbuda Gross sales Tax (ABST) base by e

“We may even finish the concessionary ABST charge relevant to a number of transactions, most notably within the tourism sector,” he mentioned, additionally asserting a rise within the ABST charge from 15 to 17per cents and making use of this charge to the tourism sector, which presently attracts a charge of 14 %.

Browne instructed Parliament that though there could also be a nominal influence on costs due to the speed adjustment, he wished to emphasise that the change within the ABST charge won’t have an effect on a wide array of meals and different important gadgets.

“Already, most of the primary meals gadgets we presently devour are zero-rated, so shoppers don’t pay ABST on them,” he mentioned, mentioning among the zero-rated gadgets resembling “most vegetables and fruit to incorporate however not restricted to bananas, oranges, grapes, potatoes, broccoli, cauliflower and lettuce, child merchandise, dry items, and oils to have pasta, sugar, corn meal, flour, rice, and cooking oils, o rooster, fish, domestically produced meats, eggs, canned sardines and tuna.

He mentioned bread, cereals, cheese and milk, water and medication, pharmaceutical provides, and grownup diapers are additionally within the zero-rated class and that “exempt provides to be used within the agriculture and fisheries sectors won’t be affected by the change within the ABST charge.”

Prime Minister Browne, additionally the Finance Minister, mentioned that by means of the Ministry of Finance, Costs and Client Affairs Division, Customs and Excise Division, and different important stakeholders, the Authorities will monitor costs because the income reforms are applied.

“Additional, the basket of important items and the checklist of price-controlled gadgets are being reviewed, and proposals can be made to the Cupboard for applicable changes,” he mentioned, including that the intention is to reduce the worth impact on major and important items and guarantee well timed interventions are made to cushion any influence on weak teams in society.

Browne mentioned that the authorities will set up the Fiscal Resilience Oversight Committee inside “a matter of weeks,” as contained within the Fiscal Resilience Tips.

He mentioned the Committee will comprise as much as seven members, drawn from the private and non-private sectors, and can embrace Antigua and Barbuda’s nation economist on the St. Kitts-based Jap Caribbean Central Financial institution (ECCB).

Browne instructed legislators that the Committee’s mandate is to evaluate and report on the Authorities’s compliance with the final fiscal duty ideas outlined within the Fiscal Resilience Tips.

“For the reason that matter of fiscal sustainability can’t be handled as partisan, we’ll invite the Chief of the Opposition to suggest a person to serve on the Fiscal Resilience Oversight Committee,” Browne mentioned, including that the extra income generated by means of the measures…will guarantee improved service supply and higher infrastructure.

“We’ve got additionally allotted EC$15 million within the funds to advance implementation of our arrears clearance technique. Whereas we intend to stay present with collectors and suppliers, we acknowledge the necessity to develop and execute a reputable technique to cut back arrears.

“It includes negotiating new financing phrases with some collectors, a course of that has already begun,” Browne mentioned, noting that for native suppliers and contractors, the Authorities will make use of a mixture of setoffs with the tax authorities, write-offs the place applicable, money funds, and issuance of bonds.

Browne mentioned the funds forecasts an total deficit of EC$80.2 million or 1.25 % of gross home product (GDP) and a major surplus of $51.8 million or 0.8 % of GDP.

He mentioned it is a vital enchancment over the projected fiscal outturn for 2023 and is in keeping with the trail in his administration’s Medium-Time period Fiscal Technique.

He instructed Parliament that complete income and grants are budgeted at EC$1.2 billion or 18.9 % of GDP. In distinction, expenditure excluding amortization funds is budgeted at EC$1.3 billion or 17.1 % of GDP.

“Amortization funds quantity to EC$569.5 million or 8.9 % of GDP, and our internet financing requirement is EC$649.7 million or 10.1 % of GDP.”

He mentioned to satisfy the web financing requirement for the fiscal bundle; the Authorities will primarily depend on the issuance of securities on the Regional Authorities Securities Market, which can quantity to EC250 million, and the disbursement of loans and advances amounting to EC$210 million.

Recurrent income is projected to be EC1.19 billion or 18.5 % of GDP, of which tax income is one billion {dollars} or 15.7 %. Non-tax income is budgeted at EC$176.9 million or 2.8 % of GDP.

Browne mentioned that it must be famous that even with the income reforms, tax to GDP, together with natural income development, will solely enhance by 0.7 % to fifteen.7 %, including, “We’ll nonetheless have the bottom tax to GDP ratio and income to GDP ratio within the area.

“In different phrases, our nation stays a low tax jurisdiction with excessive investments.”

Browne mentioned the EC$219 million in extra income from recurrent sources, in comparison with the outturn in 2023, can be achieved by means of a mixture of elevated financial exercise, elevated Citizenship by Funding (CBI) receipts, and the influence of the income reforms to be applied in 2024.

He mentioned vital contributors to tax income are direct taxes of EC$156.5 million and oblique taxes of EC$853.1 million.

Prime Minister Browne mentioned direct taxes comprise company, property, and unincorporated enterprise taxes, yielding EC$108.3 million, EC39.6 million, and EC$8.6 million, respectively.

Browne mentioned recurrent expenditure is estimated to succeed in EC$1.1 billion or 17 % of GDP in 2024. Probably the most vital recurrent expenditure element is wages and salaries, budgeted at EC461.1 million.

He mentioned it features a 9 % wage enhance for central authorities staff for EC$32 million, noting “it will full the 14 % enhance and takes impact from January 1 subsequent 12 months.

Browne mentioned he additionally wished to remind legislators that the Cupboard just lately permitted as much as a 14 % enhance for presidency pensioners.

“That is an acknowledgment of the challenges confronted by our retired public servants attributable to escalating costs over current years. These individuals have performed pivotal roles in shaping our nation, and we should present them with the means to stay comfortably and with dignity,” Browne mentioned, including {that a} committee has been assigned the duty of creating a plan to implement this enhance for presidency pensioners in 2024.

The controversy on the funds will start on Tuesday.

Associated