PORT OF SPAIN, Trinidad, CMC – The Trinidad and Tobago authorities Friday defended the brand new unitized industrial construction for Atlantic LNG that permits the state-owned Nationwide Gasoline Firm of Trinidad and Tobago (NGC) to acquire a extra important share within the income derived from the sale of LNG on the worldwide market.

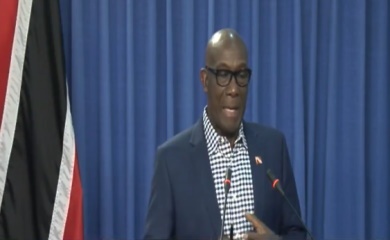

Prime Minister Dr. Keith Rowley, who led a delegation for talks in London earlier this month involving NGC, Shell, and BP, stated Trinidad and Tobago is predicted to obtain an estimated TT$11 billion (One TT greenback=US$.0.16 cents) in extra income on account of the brand new accord.

Rowley stated that had Trinidad and Tobago failed to achieve an settlement over the renegotiation of the “unprecedented settlement will present for the long-term sustainability of Trinidad and Tobago’s fuel sector and a better degree of certainty, which is essential for future funding,” it might have meant the nation going to the Worldwide Financial Fund (IMF) for help sooner or later.

Rowley stated he was dissatisfied when he heard a former power minister describe “our latest accomplishment as no massive factor,” he needed the member inhabitants to ask themselves, “What could be our place in an period of declining volumes manufacturing, falling market costs, what would have been our place had this TT$11 billion not coming to us into our income space.

“What would have been the selections in Trinidad and Tobago and? I’m not simply speaking about TT$11 billion. I’m speaking in regards to the multiplier impact because it goes via the financial system.”

Rowley stated that the contracts that had existed earlier than if the NGC didn’t present fuel to the worldwide firms, “as per the contracts these contracts had an association the place claims might have been made towards NGC.”

He stated when the nation went into the curtailment of fuel earlier than 2015, when his authorities got here into workplace, the then authorities stated it was due primarily to the necessity to keep points and really short-term.

“So we took consolation in that, those that didn’t know higher. However what was occurring, whereas the state of affairs was not upkeep, it was a real decline from our fields,” he stated, with the federal government additionally indicating the necessity to give incentives to the oil firms.

Rowley stated his administration additionally needed to negotiate varied claims made towards NGC for not assembly its obligations below the earlier contracts, totaling US$1.3 billion.

“So we needed to sit down and negotiate this. Immediately, I can inform you…(we) organized away nearly all of those claims to get the trade again into well being.

Because of the settlement, the NGC now has a ten % stake within the new industrial construction for Atlantic LNG, one yr after the federal government signed new contracts in regards to the restructuring of Atlantic LNG with bpTT, Shell, and the NGC, altering the industrial construction of Atlantic LNG- for the primary time in 27 years.

Rowley instructed reporters that as a part of the efforts to make sure fuel provides to the Atlantic challenge, the federal government had earlier been profitable in figuring out “industrial entry in a means that was by no means achieved earlier than, which is to permit us to function a Venezuelan area to get fuel commercially….each for the petro-chemical and LNG enterprise.

“Sadly, hurdles got here in the way in which as a result of relationship between Washington and Venezuela, however we efficiently negotiated that distinctive association between Trinidad and Tobago and Venezuela.”

“That’s nonetheless within the pipeline, alive and effectively as we cross the numerous hurdles.”

He instructed reporters the settlement signed in London would additionally facilitate a market-reflective pricing mechanism that gives honest worth from the sale of LNG for each Trinidad and Tobago and the shareholders and would permit for an intensified concentrate on Atlantic’s operational effectivity and reliability.

He stated that the settlement permits for the sale of fuel on the worldwide market somewhat than solely in the USA, which has the “lowest costs for fuel” as a result of North America is “awash with fuel.

“However in Europe and Asia, the value is excessive, and naturally, those that market fuel know that Shell is the biggest marketer of fuel on the planet. Shell is our companion, and so we negotiated an association the place income streams will come to us now, not from the nearly completely low Henry Rob reference, however from a basket of market costs, excessive in Japan, excessive in Korea, excessive in Europe, joint in the USA. If you common it out, we have now a greater income stream.

“And that’s the reason at the same time as our volumes are reported to have gone down, the federal government acted this manner efficiently. You didn’t see an equal collapse within the income in Trinidad and Tobago.”

Rowley insisted that had his administration not taken measures to take care of the low returns from the power sector on coming to energy in 2018, “it could have been probability that Trinidad and Tobago would have ended up on the IMF.

“However definitely, we’d have ended up with an enormous foreign money devaluation. These have been the choices we confronted as a result of what have been the options within the absence of those successes? How will we keep the bills that we had develop into accustomed to,” he stated, telling reporters that his administration had all the time insisted on prescribing “our personal drugs, and we’ll take it.

“No person goes to lend you cash as a lender of final resort and mean you can proceed to do the next issues when you increase your financial system with lending, free training from cradle to college, free well being care, subsidizing water, subsidizing electrical energy, subsidizing gasoline.

“If we ever discover ourselves on an IMF avenue, the standard of lifetime of all people on this nation is threatened as a result of a number of what the federal government carries on its payroll is not going to be permitted in any important means,” Rowley stated, acknowledging the risk additionally to the fuel and oil trade by some segments of the worldwide neighborhood in favor of renewable power.

Associated