MIAMI – The digitalization of the financial system has gained increasingly more momentum all over the world and the Latin American and Caribbean area has not been left behind. In an ever-changing world, technological improvements are altering the way in which we work together day-after-day, and this extends to the funds business, reworking the way in which on a regular basis funds are made and the way folks spend or handle their cash.

To study extra about the primary strategies and components that buyers contemplate when making a cost, as a part of the Mastercard LAC Innovation Discussion board, Mastercard presents its new analysis that investigates the cost behaviors of shoppers in 14 international locations in Latin America and the Caribbean.

Fundamental Findings

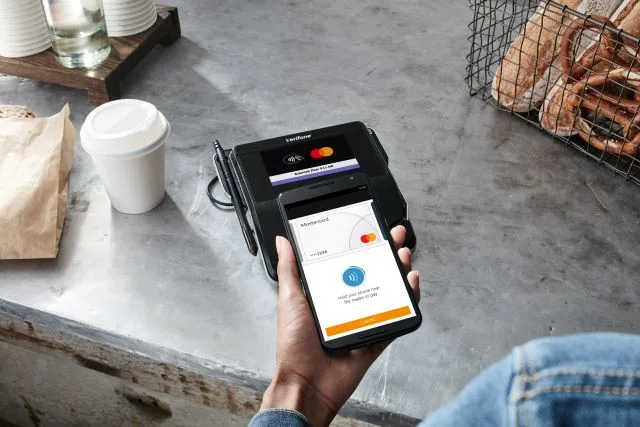

In line with the primary findings, over the previous few years using varied different cost strategies has elevated: 77% of the shoppers have used digital funds, with credit score and debit being essentially the most utilized cost instrument each on-line and in-store. Debit has been highlighted as an important digital cost technique, utilized by 63% of shoppers.

“Digitalization in Latin America is a phenomenon that’s right here to remain, as it’s introduced as an answer to the wants that Latin People face day-after-day. Mastercard has been recognized for being on the forefront of essentially the most present expertise developments and that features innovating on the tempo of shoppers. New cost strategies have grow to be instruments that facilitate funds and transfers, which is why Mastercard has partnered with a number of digital wallets in varied markets in Latin America and the Caribbean with the goal of offering the perfect cost expertise to all shoppers” stated Walter Pimenta, Government Vice President of Merchandise and Engineering for Mastercard Latin America and the Caribbean.

With Open Arms: Latin American Customers Are Open to the Use of Applied sciences in Funds

Folks in Latin America and the Caribbean proceed to exhibit their openness to testing new cost strategies and their adoption of digital cost strategies. On this regard, playing cards proceed to be the popular medium and use of different digital strategies has elevated exponentially, whereas using money has decreased.

The usage of money has been declining lately, with a 3rd of shoppers indicating that their desire for this selection has been displaced by the digitization of funds. As well as, greater than half of shoppers surveyed (63%) indicated that they have been very comfy utilizing new applied sciences.

On this context, it’s value highlighting:

- Debit playing cards are essentially the most used cost technique, with a utilization charge of 55% and 41% for in-store and on-line purchases, respectively. Right here, Chile is the nation with the very best penetration of debit playing cards, each in-store (82%) and on-line (72%).

- 50% of shoppers point out that the adoption of digital funds is motivated by decreasing using money. The second motive, with 45%, is as a result of velocity of the transaction. Greater than in another market within the area, 60% of Argentinian customers carry much less bodily cash with them.

- Whereas the introduction of latest cost strategies has elevated, shoppers want digital wallets when making a purchase order in a retailer as a consequence of comfort (45%), velocity (44%), and accessibility/person expertise (44%).

- Two-thirds of shoppers use digital wallets for on-line or in-store transactions. The international locations that make the very best use of this kind of cost are Argentina and Uruguay, the place greater than 80% of shoppers have used it.

- Digital wallets primarily attraction to younger adults, much more so in the case of making on-line funds. 44% of shoppers between the ages of 18 and 30 cited comfort as the highest issue driving their on-line cost preferences.

- When making a purchase order, 44% of shoppers use a cell system to carry out a transaction. The nation the place these units are most used for funds is Brazil (86%), whereas in Jamaica it’s the reverse, the place this kind of cost has not been carried out for essentially the most half (13%).

Safety: A Key Issue within the Use of Playing cards

Throughout the funds ecosystem, shoppers are on the lookout for frictionless experiences that enable them to make and obtain funds simply, rapidly, and most significantly, securely. Safety – and particularly the concern of fraud – is the primary issue that determines client conduct in relation to the cost strategies they use.

In truth, 83% of Latin People indicated that safety features are essentially the most influential side when selecting which cost technique to make use of, adopted by the safety of client monetary info at 79%.

With regards to enthusiastic about safe cost strategies, debit playing cards take the highest spot. In line with respondents, debit playing cards are the cost technique they absolutely belief (36%), adopted by financial institution switch (34%) and bank cards (27%). On this case, Uruguayan respondents stand out, who with 67% are those who really feel the most secure when making transactions with their debit playing cards, whereas Colombians are those who discover them much less safe (11%).

“We all know that cyberattacks are a rising concern within the Latin American area for all shoppers. Folks deserve the power to make funds conveniently, rapidly and simply with out compromising their safety. That’s why Mastercard is repeatedly taking the mandatory actions to strengthen the safety of our shoppers by means of a holistic cybersecurity technique. To make sure a safe digital ecosystem, we use knowledge analytics and AI to determine vulnerabilities upfront and activate automated safety shields for all our shoppers,” stated Pimenta.

Privateness as a prime precedence

Customers in Latin America and the Caribbean are extremely involved about their knowledge privateness on the planet of digital transactions, the place 73% of respondents stated privateness is a prime precedence, and that they all the time select cost strategies that defend person knowledge.

Additionally, 96% say they take steps to guard their knowledge. Among the many predominant measures that respondents take to guard their privateness are:

- Utilizing safe and dependable cost platforms – 45%

- Keep away from sharing delicate monetary info on-line – 45%

- Use sturdy, distinctive passwords for monetary accounts – 44%

Scope and methodology of the analysis

Research markets embody Argentina, Brazil, Chile, Paraguay, Peru, Uruguay, Ecuador, Colombia, Panama, Costa Rica, Mexico, Dominican Republic, Jamaica and Puerto Rico. The analysis passed off between November 1st 2023 and November 19th 2023 and consisted of a survey of 9,489 adults aged 18 and over.